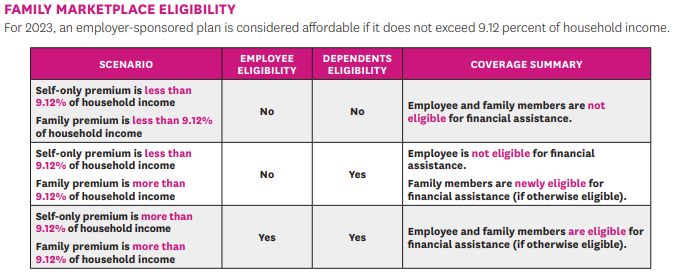

Yes, employees in the United States can get marketplace insurance. Most job-based health insurance plans are designed for your employer to pay a portion of your monthly premium. However, if you enroll in a Marketplace plan instead, the employer won’t contribute to your insurance premium. If you have job-based insurance and want to check out options in the Health Insurance Marketplace, you can do that here. But there are several important things to know first. You can change to a Marketplace plan if you have job-based coverage now, but you probably won’t qualify for a premium tax credit or other savings. As long as the job-based plan is considered affordable and meets minimum standards, you won’t qualify for savings. The Chart below will give you more information.

A new ACA rule fixes the Marketplace “Family Glitch”– Increasing the number of individuals eligible for Marketplace coverage in 2023. Until now under the Patient Protection and Affordable Care Act (ACA), employer offered coverage was considered affordable for all family members to whom an employer’s offer extends if the premium for the employee’s self-only coverage was considered affordable. The premium required to cover family members was not considered in deciding on subsidy. However, beginning plan year 2023, if an employee is offered employer coverage that extends to their family members, the affordability of employer coverage will be based on the family premium cost, not the Employee only premium cost. Family members will be eligible for financial assistance on the Marketplace if the employee’s family premium cost is considered unaffordable.

OPTIONS FOR COVERING THEIR FAMILY

● Split Coverage (Employer and Marketplace): Employee could enroll in the affordable employer coverage, while

their family members enroll in a Marketplace plan with APTC/CSRs if otherwise eligible.

● Employer Coverage Only: Whole family could enroll in the employee’s offer of employer-sponsored coverage.

While someone is enrolled in employer coverage, they aren’t eligible for financial assistance on a Marketplace plan.

● Marketplace Coverage Only: Employee could decline the affordable employer coverage, and the whole family could

enroll in a Marketplace plan. They will pay full price for the employee’s portion of the Marketplace plan premium, while

other family members’ portions would be lowered by using APTC and/or CSRs if they are otherwise eligible.